According to the section 195 of the 1961 Income Tax Act, every single person who is liable for making payment to all the non residents, their TDS shall be deducted from the payment done by them. The amount given to the non-residents at the rates of force shall also be deducted. In this 15 CA CB are the major factors, it matters a lot. The RBI also makes it mandatory, apart from some critical cases which are specially mentioned in this act, no remittance can be made to a nonresident unless it is furnished under the undertaking of 15 CA CB. Usually 15CA is accompanied by CB.

The ultimate purpose of 15 CA CB is meant to collect taxes on time ie. The time when the remittance is being made. As if the collection is not done during this time it becomes very difficult to collect taxes later from the non-residents. The undertaking format of 15 CA CB is filled by electronic process. The format in the certification account in the form 15 CA CB is to be notified by the rule of 37 BB as per the income tax for the year 1962.

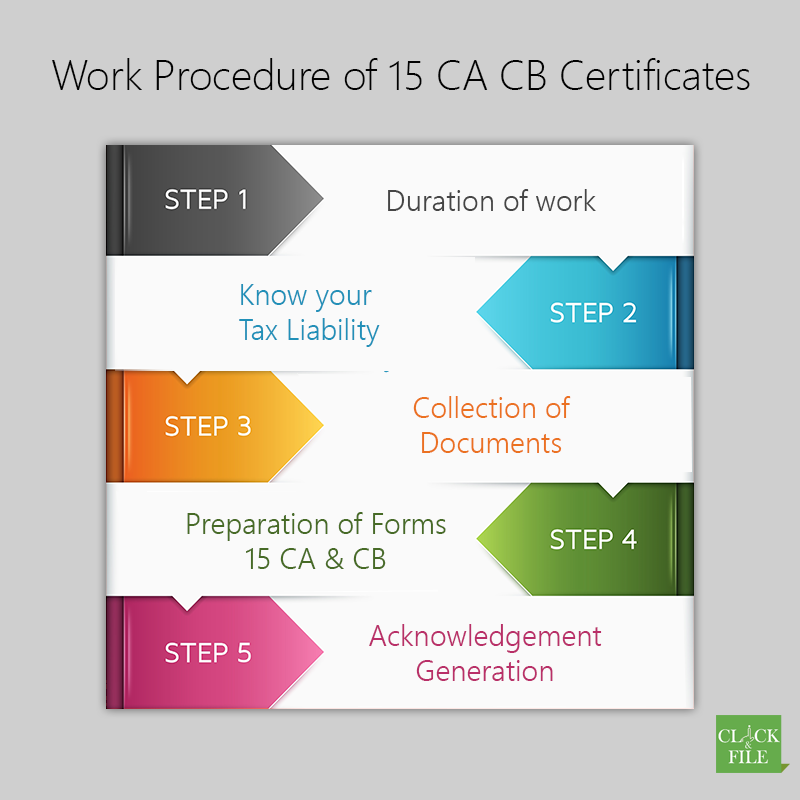

The complete procedure of furnishing the form 15 CA CB:

- The person who is making the payment will get a certificate from the accountants side

- The one who is making the payment will have to electronically upload the undertaking which contains the details about the department.

- The information contained in the form has to be filled using the information in the 15 CB

- The remitter will have to take out a print for this filled form and will have to sign it. Later 15 CA CB has to be signed by the one who is authorized to sign the returning income of the remitter or the person who is authorized in terms of the written form

- The signed forms from 15 CA CBhas to be submitted in duplicate copy to the RBI or any authorized dealer. The RBI then has the responsibility of forwarding the copy of this certificate to the concerned officer

- The remitter who has got a certificate from the concerned officer regarding the amount and the rate. The amount that has to be deducted in the form of tax does not require any certification. It only requires to be furnished from 15 CA CB.

Guidelines for 15 CA CB:

- The tax will be deducted from the source itself

- Remitter has got an order under the section 195

- If you have given an invalid PAN number, the form will not be rejected, it will not be generated

- No value will be entered in the area code

After you have filled the form you will receive a confirmation on your electronic screen. This will be a final confirmation of 15 CA CB.