Citibank credit card is the best product for any purpose. They can give a loan with the low-interest rate, provide services with extra facilities and more. This bank has an operational presence of over 45 branches in 28 cities. They can serve banking needs according to every individual’s lifestyle. Citibank can give a wide range of services.

They offer a host of credit cards for different types of customers. Their products specially designed for travel, shop, dine and rest advantages so that you can fulfill your wishlist without any burden. As a cardholder, you can also earn reward points, cash back, gift vouchers, and more.

Citibank credit card application procedure has two an online or offline. You can choose any of the options as per your convenience. Each service is available for you, should apply and enjoy the discounts, offers and rest facilities.

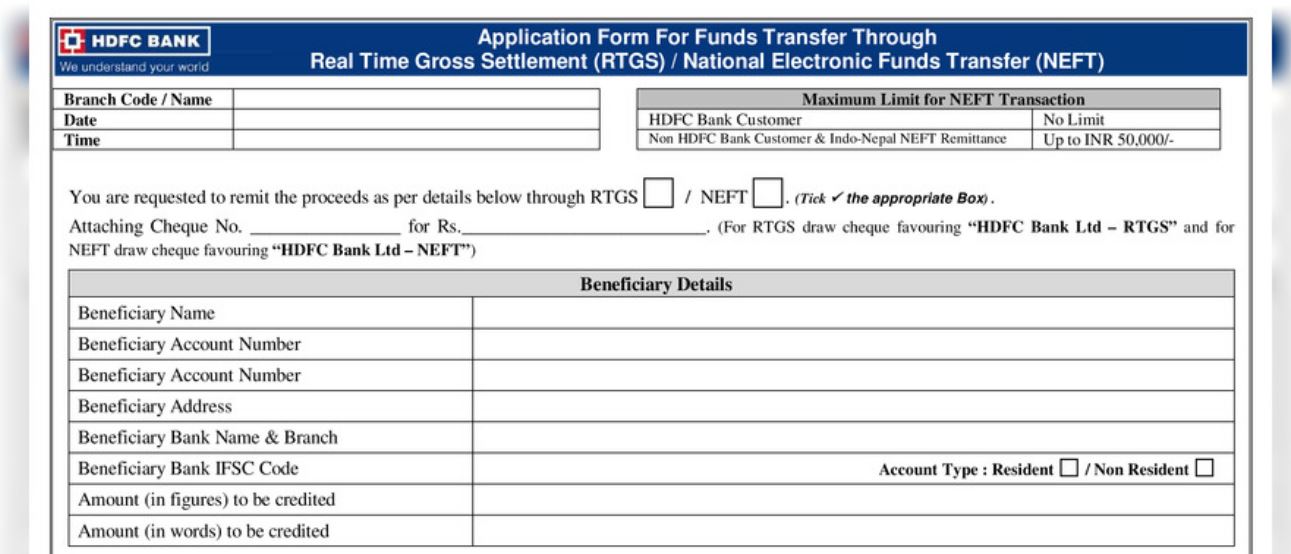

When you select the offline option, should visit the nearest bank branch. Fill the physical application form along with providing self-attested documents. Share registered email ID or mobile number, and a recent passport size recent photograph.

When you feel the easy and comfortable way the online, should go to the official site and select the product. You can choose the product as per your lifestyle or spending habits. Fill the application form with the full name, date of birth, and gender, employment type, registered postal address, and a recent passport photograph.

For both process, should provide correct and proper information. The bank can cross-check all the details then give approval. When shared all data according to the bank’s norm nobody will stop you, and it will take 2 to 3 weeks to receive a card.

What Are The Basic Requirements For A Citibank Cardholders?

To get immediate approval for this bank’s product, should check online your age, income, and KYC. These are the main steps, should check and go ahead step by step. You can check online their requirements and needs as per the income. If all your filled match with the Citibank, then nobody will stop you.

You should be 18 years of age with a clear CIBIL score. CIBIL can play the main role in front of card approval. If you will get less than 650 means out of the range and more than 750 gives an indication to have a loan or credit card approval.

You can also share identity proof, address proof, and income proof. For identity voter ID, driving license, and passport needs to submit. For residential address should submit aadhaar, a recent electricity bill, and phone bill. And for income have to give a copy of income tax return, recent salary slip, or bank statement. They ask for income proof because it can show your credibility, the capacity for repayment or payment on time.

When you are using the product and have a problem related to the Citibank credit card features, cash back, points or anything should call on customer care toll-free 1860 2102 484 and get a prompt response.